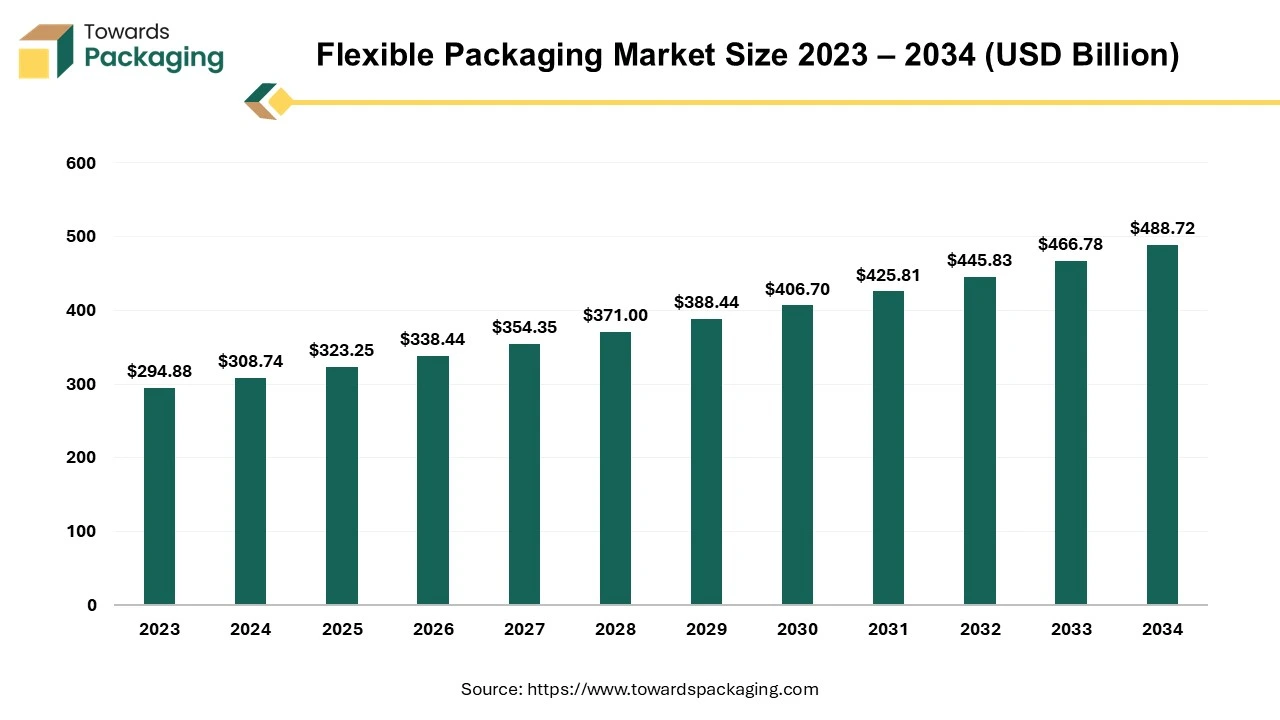

Flexible Packaging Market Size to Attain USD 488.72 Bn by 2034

As detailed in the latest report by Towards Packaging, the global flexible packaging market is forecast to grow from USD 338.44 billion in 2026 to about USD 488.72 billion by 2034, at a CAGR of 4.7% between 2025 and 2034.

Ottawa, Oct. 15, 2025 (GLOBE NEWSWIRE) -- The global flexible packaging market, which stood at USD 323.25 billion in 2025, is projected to grow further to USD 488.72 billion by 2034, according to data published by Towards Packaging, a sister firm of Precedence Research.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

The market is witnessing robust growth, driven by rising demand for lightweight, durable, and sustainable packaging solutions across the food, beverage, and pharmaceutical industries. Technological advancements in materials and printing have enhanced product shelf life and visual appeal.

Asia Pacific dominated the market due to the expanding manufacturing sector, rapid urbanization, and increasing consumption of packaged goods in countries such as China, India, and Japan. The shift toward eco-friendly and recyclable packaging further boosts adoption.

What is meant by Flexible Packaging?

The flexible packaging market holds immense growth opportunities in the future due to increasing demand for convenient, lightweight, and sustainable packaging solutions across industries. Flexible packaging refers to materials such as films, foils, and laminates that can easily bend or form different shapes without breaking.

It is widely used for products like snacks, beverages, pharmaceuticals, and cosmetics, offering benefits like extended shelf life, cost efficiency, and reduced material usage. With rising environmental concerns, manufacturers are focusing on recyclable and biodegradable materials, opening new avenues for innovation and expansion. Growing e-commerce activities and food delivery services are further driving market potential.

What Are the Latest Trends in The Flexible Packaging Market?

1. Sustainability & Eco-friendly Materials

Growing regulatory pressure and consumer demand are pushing brands toward recyclable, compostable, or biodegradable films and laminates. Use of PCR (post-consumer recycled) plastics and mono-material designs that simplify recycling is increasing.

2. Barrier & Material Innovation

New multi-layer films, improved barrier coatings (against oxygen, moisture, light), and more durable yet lightweight materials are being developed to extend shelf life and reduce waste.

3. Smart Packaging Technologies

Integration of QR codes, NFC/RFID, freshness indicators, and tamper-evident features to improve traceability, consumer engagement, safety, and anti-counterfeiting.

4. Digital Printing & Customization

Brands are using digital printing for shorter runs, variant designs, more attractive visuals, and personalization to stand out. This also allows for more agile production.

5. E-commerce Packaging

With the rise of online retail, there is a rising demand for packaging that's durable during transit, lightweight, compact, and conveniently resealable. Formats like stand-up pouches, mailer bags, resealable bags etc. are growing.

6. Circular Economy & Reduced Plastic Use

Focus on designing packaging for end-of-life (recycling, composting), reducing single-use plastics, and moving to more sustainable paper-based or bio-based substrates.

7. Regulatory Compliance & ESG

Laws across regions (EU, US, Asia Pacific) are pushing for more recycled content, limits on certain plastics, and extended producer responsibility. Companies are aligning with ESG goals.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5057

What Potentiates the Growth of the Flexible Packaging Market?

Advancements in Material Science and Technology

Advances in materials science and technology are critical in driving market growth. Recently, manufacturers introduced mono-material films with high barrier properties (e.g., Innovia Films’ new PP films CHS and CHT) that replace multi-layer laminates, improving recyclability without compromising thermal or moisture protection.

Barrier-coated paper solutions are also gaining traction: Mondi launched a paper-based barrier material in mid-2025 with very low oxygen and water vapor transmission rates suitable for food packaging. Meanwhile, companies like Dow have developed new recyclable resin blends (e.g., for BOPE films) used with post-consumer recycled content, enabling fully recyclable pouch packaging in major markets like China. These innovations help satisfy rising regulatory demands, sustainability expectations, and performance needs, pushing flexible packaging adoption further.

Limitations & Challenges in the Flexible Packaging Market

Stringent Regulatory Pressure & Lack of Adequate Recycling Infrastructure

Key players in the market are facing issues due to stringent regulatory pressure and inadequate recycling infrastructure. Governments are imposing tougher rules on single-use plastics, packaging waste, and environmental impact, forcing manufacturers to invest heavily in compliance and more sustainable materials. Especially in developing regions, infrastructure for collecting, sorting, and processing flexible packaging waste is underdeveloped or inconsistent.

More Insights of Towards Packaging:

- Metalized Flexible Packaging Market Growth, Innovations, and Market Size Forecast 2034 - The global metalized flexible packaging market size reached USD 15.30 billion in 2025 and is projected to hit around USD 22.76 billion by 2034.

- Compostable Flexible Packaging Market Size & Investment Opportunities - The compostable flexible packaging market is expected to increase from USD 1.41 billion in 2025 to USD 2.37 billion by 2034.

- Flexible Plastic Packaging Market Growth, Sustainability, and Consumer Trends (2025-2034) - The global flexible plastic packaging market is projected to grow from USD 205.76 billion in 2025 to USD 319.20 billion by 2034.

- E-Commerce Flexible Packaging Market Size, Trends, Growth and Sustainability Outlook (2025-2034) - The E-Commerce Flexible Packaging Market is projected to grow at a CAGR of 8.50%, reaching USD 79.75 billion by 2034.

- Flexible Intermediate Bulk Container (FIBC) Market Size, Segments, Regional Data & Competitive Analysis 2025–2034 - The Flexible Intermediate Bulk Container (FIBC) market is projected to grow from USD 8.48 billion in 2025 to USD 13.64 billion by 2034.

- Nutraceutical Flexible Packaging Market Size, Trends, Share, and Innovations 2034 - The nutraceutical flexible packaging market is experiencing rapid growth, with substantial revenue increases expected from 2025 to 2034.

- Medical Flexible Packaging Market Trends, Share, and Growth Analysis 2034 - The medical flexible packaging market is anticipated to grow from USD 21.48 billion in 2025 to USD 34.78 billion by 2034.

- Flexible Plastic Pouches Market Recycling Rates and Technologies - The flexible plastic pouches market is projected to reach USD 306.72 billion by 2034, growing from USD 198.46 billion in 2025.

- Flexible Polyurethane Foam Market Demand, Size, and Growth Rate Forecast 2034 - The global flexible polyurethane foam market size reached US$ 5.95 billion in 2024 and is projected to hit around US$ 10.86 billion by 2034.

- Multilayer Flexible Packaging Market Analysis, Demand, and Growth Rate Forecast 2034 - The global multilayer flexible packaging market is estimated to reach USD 283.55 billion by 2034, up from USD 168.92 billion in 2024.

- Converted Flexible Packaging Market Research, Consumer Behavior, Demand and Forecast - The global converted flexible packaging market is expected to increase from USD 284.16 billion in 2025 to USD 381.13 billion by 2034.

- Recycling Flexible Packaging Market Strategic Growth, Innovation and Investment Trends - The recycling flexible packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034.

- North America Flexible Packaging Market Mergers & Green Innovations Fuel Growth - The North America flexible packaging market is expected to increase from USD 84.9 billion in 2025 to USD 123.07 billion by 2034.

- Polyethylene Packaging Market Innovations - The polyethylene packaging market is expected to increase from USD 120.63 billion in 2025 to USD 168.81 billion by 2034.

-

Flexible Industrial Packaging Market Drives at 4.93% CAGR (2025-34) - The flexible industrial packaging market is forecast to grow from USD 85.35 billion in 2025 to USD 130.92 billion by 2034.

Regional Analysis:

Who is the leader in the Flexible Packaging Market?

Asia Pacific dominated the market in 2024 due to several interlinked factors. First, large and growing populations in countries like China and India are urbanizing rapidly, creating strong demand for ready-to-eat, packaged, and on-the-go food & beverage products.

Second, rising disposable incomes and a burgeoning middle class are increasing the consumption of packaged goods, personal care items, and pharmaceuticals. The region also benefits from cost-competitive manufacturing, abundant raw materials, and favorable labor costs, which make production of flexible packaging more economical.

Moreover, the rapid expansion of e-commerce and modern retail channels in Asia-Pacific demands packaging that is lightweight, protective, and suitable for transit, all of which are strengths of flexible formats. Finally, increasing regulatory and consumer pressure toward sustainability is pushing manufacturers to adopt recyclable, biodegradable, or mono-material flexible packaging, which is being actively developed in the region.

India Market Trends

India’s market is driven by rising disposable incomes, growing urbanization, and a shift toward convenience and single-serve products. The food & beverage segment dominates, supported by expanding organized retail and strong growth in processed foods. E-commerce is also boosting demand, requiring efficient, lightweight packaging. In response to environmental concerns, there is increasing innovation around biodegradable films, recyclable materials, and government policies like the Plastic Waste Management Amendment Rules. Major players like Uflex, Polyplex, Cosmo Films, and global entrants are expanding capacity and investing in specialty films and barrier laminates to meet evolving requirements.

China Market Trends

In China, regulatory changes emphasizing food safety and shelf life are promoting high-barrier and active flexible packaging formats. Rapid urbanization and evolving consumer lifestyles are fueling demand for convenience packaging, especially with the growth in food delivery and ready-to-eat meals.

The shift toward eco-friendly materials is also strong, with biodegradable, compostable, and recyclable films increasingly being adopted. Packaging innovations are being pushed both by stricter standards (e.g., limiting packaging layers, reducing waste) and by consumer expectations for sustainability and safety.

Japan Market Trends

Strong regulatory frameworks and consumer preferences shape Japan’s market. New laws, such as the positive list system for food-contact synthetic resins (effective June 2025) and stricter standards under the Food Sanitation Act, are compelling packaging producers to use safer, approved materials. Sustainability is a major driver: bio-polypropylene and other bio-based materials are being adopted by leading brands. E-commerce expansion also boosts demand for flexible plastic packaging that is lightweight, protective, and designed for consumer convenience.

South Korea Market Trends

South Korea’s flexible packaging market growth is being driven by strong consumer awareness of sustainability, along with government policies aimed at reducing plastic usage and promoting recycling. The flexible paper packaging segment is growing noticeably, with kraft paper leading and greaseproof paper rising fast. Single-serve flexible plastic formats are increasingly popular, particularly in food & personal care, driven by convenience and changing lifestyles. However, challenges around actual recycling rates, regulatory consistency, and handling plastic waste remain.

How is the Opportunistic Rise of North America in the Flexible Packaging Market?

North America is expected to grow at the fastest rate in the coming years, propelled by several reinforcing factors. A major driver is booming e-commerce and on-the-go food & beverage formats, which demand lightweight, durable, tamper-proof flexible packs like pouches and films.

Strong regulatory pressure and sustainability mandates push companies toward recyclable, compostable, or mono-material flexible packaging designs. High R&D investment and technological advances, such as improved barrier films, smarter printing, and novel bioplastics, enhance performance and allow stricter food safety, pharmaceutical, and consumer preferences.

U.S. Market Trends

The U.S. leads North America in flexible packaging due to its strong e-commerce sector, demand for convenient formats (pouches, resealable bags) in food, pet food, and personal care, and a regulatory push toward sustainability. Advances like digital watermarking help improve film sortation for recycling. Producers are investing in bioplastics, high-barrier films, and replacing rigid packaging to meet consumer and environmental expectations.

Canada Market Trends

Canada’s market is shaped by regulatory initiatives (e.g. bans on single-use plastics, extended producer responsibility) and strong consumer demand for sustainable, lightweight packaging. Growth is especially strong in multi-layer, high-barrier flexible packaging for food and e-commerce. The federal Plastics Registry, the Canada Plastics Pact, and rising use of fiber-based solutions are pushing manufacturers toward circular economy models and more recyclable flexible formats.

What Makes Europe a Notably Growing Area?

Europe is expected to experience notable growth in the market due to several key factors. The region's strong regulatory frameworks, such as the EU's Circular Economy Action Plan and the European Green Deal, are driving the adoption of sustainable packaging solutions. These policies encourage the use of recyclable, biodegradable, and reusable materials, aligning with increasing consumer demand for eco-friendly products.

Additionally, the rise of e-commerce has amplified the need for lightweight, protective, and cost-effective packaging, further boosting market expansion. Technological advancements in packaging materials and design are also contributing to the market's growth, enhancing product safety and shelf life.

How Crucial is the Role of Latin America in the Flexible Packaging Market?

Latin America’s market is growing due to several key factors. The rising demand for convenient, lightweight packaging solutions is a fundamental driver, particularly in the food and beverage industry.

Additionally, there is an increasing focus on sustainability, with both consumers and businesses pushing for eco-friendly and recyclable materials. Technological innovations, such as intelligent labels and interactive packaging features, are gaining traction, aligning with shifting preferences towards smart packaging solutions.

How Big is the Opportunity for the Growth of the Middle East and Africa Flexible Packaging Market?

The Middle East and Africa (MEA) present significant growth opportunities in the market, driven by urbanization, rising disposable incomes, and increasing demand for packaged food and beverages.

Key drivers include the adoption of advanced packaging technologies, a shift towards sustainable materials, and the growth of e-commerce and modern retail channels. Countries like Saudi Arabia, South Africa, and Egypt are leading the way in market development.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Raw Material Insights

The plastic segment dominated the flexible packaging market in 2024 due to its cost-effectiveness, versatility, and performance advantages. Plastic materials are lighter than alternatives like glass or metal, reducing transportation costs and energy consumption. They offer excellent barrier properties, extending shelf life and preserving product quality.

Additionally, plastics can be molded into various shapes, allowing for innovative designs and customization. Their adaptability and efficiency make them the preferred choice across industries such as food, beverages, pharmaceuticals, and personal care.

The bioplastics segment is expected to grow at the fastest rate in the upcoming period, driven by increasing consumer demand for sustainable and biodegradable alternatives to conventional plastics. Government regulations, such as bans on single-use plastics and extended producer responsibility laws, are accelerating this shift. Innovations in bioplastic materials, including those derived from renewable sources like corn, seaweed, and sugarcane, are enhancing performance and biodegradability, further boosting adoption across various industries.

Packaging Type Insights

The pouches segment led the flexible packaging market in 2024 due to their versatility, convenience, and cost-effectiveness. Pouches offer lightweight, space-efficient packaging, reducing transportation and storage costs. Their ability to stand upright enhances shelf visibility and consumer appeal.

Features like resealable zippers and spouts improve product usability and freshness. Pouches also provide excellent barrier properties, extending shelf life and preserving product quality. These advantages make pouches a preferred choice across various industries, including food, beverages, and personal care.

The bags & trays segment is likely to grow at a significant rate over the forecast period due to their versatility, cost-effectiveness, and suitability for a wide range of applications. Bags, including gusseted and wicketed varieties, are extensively used in food, retail, and pharmaceutical sectors for their ability to handle bulk quantities efficiently.

Trays, often used in conjunction with films or wraps, provide structural support and are ideal for fresh produce, meat, and ready-to-eat meals. Their lightweight nature reduces transportation costs, while their compatibility with automation enhances packaging efficiency in high-volume environments. These factors collectively contribute to the segment's prominence in the flexible packaging industry.

Printing Technology Insights

The flexography segment dominated the flexible packaging market in 2024 due to its versatility, speed, and cost-effectiveness. It accommodates a wide range of substrates, including plastics, films, foils, and biodegradable materials. Flexographic printing supports high-speed production, making it ideal for large-volume runs.

The use of water-based and UV-curable inks aligns with sustainability goals by reducing environmental impact. Additionally, flexography enables the application of special effects like metallic finishes and matte-gloss combinations, enhancing brand appeal. Its strong adhesion properties ensure durability, making it suitable for various packaging formats such as pouches, bags, and wraps.

The digital printing segment is expected to grow at a notable rate in the coming years due to its ability to handle short print runs and variable data printing efficiently. This capability is essential for meeting the increasing demand for personalized packaging solutions and targeted marketing campaigns, allowing brands to engage with consumers on a more intimate level and drive brand loyalty. Additionally, digital printing eliminates the need for printing plates, reducing setup times and costs, making it an attractive option for brands seeking flexibility and cost efficiency.

Application Insights

The food & beverages segment dominated the flexible packaging market due to the industry’s need for lightweight, versatile, and cost-effective packaging that maintains product freshness and extends shelf life. Flexible formats such as pouches, sachets, and stand-up bags are preferred for convenience, reduced material usage, and transportation efficiency. Additionally, the growth of e-commerce and modern retail channels is driving increased adoption of flexible packaging in this sector.

The pharmaceutical segment is expected to grow at the fastest CAGR over the forecast period due to the increasing demand for safe, compliant, and patient-friendly packaging solutions. Rising healthcare expenditures, the expansion of drug production, and the growing prevalence of chronic diseases drive the need for packaging that ensures product integrity and supports unit-dose formats. Flexible packaging solutions, such as high-barrier pouches, sachets, and strip packs, offer protection against moisture, light, and oxygen, preserving drug stability and enhancing patient safety.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Recent Breakthroughs in the Global Flexible Packaging Market

- In August 2025, ProAmpac introduced its ProActive Recycle-Ready polyolefin-based platform, designed for high-speed chunk cheese applications. This innovation offers exceptional performance without compromising shelf life or runability, marking a significant advancement in recyclable dairy packaging.

- In August 2025, Dow launched the INNATE TF 220 Precision Packaging Resin, aimed at enhancing the recyclability and performance of flexible plastic packaging. This resin is used in the production of BOPE films and has been employed by Chinese detergent brand Liby in its Floral Era product line, resulting in one of China's first fully recyclable laundry detergent packages.

- In September 2025, CelluForce unveiled CelluShield, a bio-based, high-performance barrier coating for recyclable flexible packaging. This innovation combines product protection with sustainability, helping packaging manufacturers meet the growing demand for recyclable solutions without compromising shelf life.

- In February 2025, All4Labels launched its flexible packaging division, All4Flexibles, bringing digital innovation and sustainable solutions to the packaging industry. This move aims to enhance the company's offerings in the flexible packaging market.

Global Flexible Packaging Market Top Key Players

- Amcor

- Mondi

- Sonoco Products Company

- Sealed Air

- Huhtamaki

- Transcontinental Inc

- Cosmo Films Ltd

- Polyplex

- UFlex Limited

- Jindal Poly Films

- CLONDALKIN GROUP

- Constantia Flexibles

- TAGHLEEF INDUSTRIES GROUP

- DUNMORE

- Celplast Metallized Product

- Ultimet Films Ltd

- Accrued Plastic Ltd

- All Foils, Inc.

- SRF Limited

Global Flexible Packaging Market Segments

By Raw Material

- Paper

- Plastics

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Others

- Bioplastic

- Aluminum

- Cellulosic

- Metal

By Packaging Type

- Bags and Trays

- Gusseted Bags

- Wicketed Bags

- Pouches

- Stand up Pouches

- Flat Pouches

- Spouted Pouches

- Films

- Bag-in-box

- Blisters

- Others

By Printing Technology

- Flexography

- Digital Printing

- Retrogravure

- Others

By Application

- Food & Beverages

- Pharmaceutical

- Cosmetics

- Others

By Region:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5057

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging Releases Its Latest Insight - Check It Out:

- Eco-Friendly Flexible Packaging Market Trends 2025: Bioplastics and Online Retail Set to Surge - https://www.towardspackaging.com/insights/eco-friendly-flexible-packaging-market-sizing

- Germany Flexible Packaging Market Growth, Innovations and Market Size - https://www.towardspackaging.com/insights/germany-flexible-packaging-market-sizing

- Leak-Proof Flexible Packaging Market Size, Share, Trends and Growth Forecast - https://www.towardspackaging.com/insights/leak-proof-flexible-packaging-market-sizing

- Renewable Material Packaging Market Size and Regional Production Analysis - https://www.towardspackaging.com/insights/renewable-material-packaging-market-sizing

- Flexible Industrial Packaging Market Size, Demand and Trends Analysis - https://www.towardspackaging.com/insights/flexible-industrial-packaging-market-sizing

- Polyethylene Packaging Market Size, Demand and Trends Analysis - https://www.towardspackaging.com/insights/polyethylene-packaging-market-sizing

- North America Flexible Packaging Market Size, Demand and Trends Analysis - https://www.towardspackaging.com/insights/north-america-flexible-packaging-market-sizing

- Recycling Flexible Packaging Market Size and Regional Production Analysis - https://www.towardspackaging.com/insights/recycling-flexible-packaging-market-sizing

- Converted Flexible Packaging Market Size, Trends, Share and Innovations - https://www.towardspackaging.com/insights/converted-flexible-packaging-market-sizing

- Multilayer Flexible Packaging Market Intelligence Report, Key Trends, Innovations & Market Dynamics - https://www.towardspackaging.com/insights/multilayer-flexible-packaging-market-sizing

- Strategic Insights into the Flexible Polyurethane Foam Market's Expansion - https://www.towardspackaging.com/insights/flexible-polyurethane-foam-market-sizing

- Flexible Plastic Pouches Market Sustainability & Circular Economy Data - https://www.towardspackaging.com/insights/flexible-plastic-pouches-market-sizing

- Medical Flexible Packaging Market Review, Key Business Drivers & Industry Forecast - https://www.towardspackaging.com/insights/medical-flexible-packaging-market-sizing

- Flexible Paper Packaging Market Size and Growing Demand - https://www.towardspackaging.com/insights/flexible-paper-packaging-market-sizing

- Nutraceutical Flexible Packaging Market Performance, Trends and Strategic Recommendations - https://www.towardspackaging.com/insights/nutraceutical-flexible-packaging-market-sizing

- Strategic Insights on the Growing Flexible Intermediate Bulk Container (FIBC) Market - https://www.towardspackaging.com/insights/fibc-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.